The National Assembly is planning to bring in the amendment of Credit Information Act as an item for Legislation & Judiciary Committee and have discussions. It will be interesting to see whether the data industry, which is open without any business, will finally see the light at the end of the tunnel after many years.

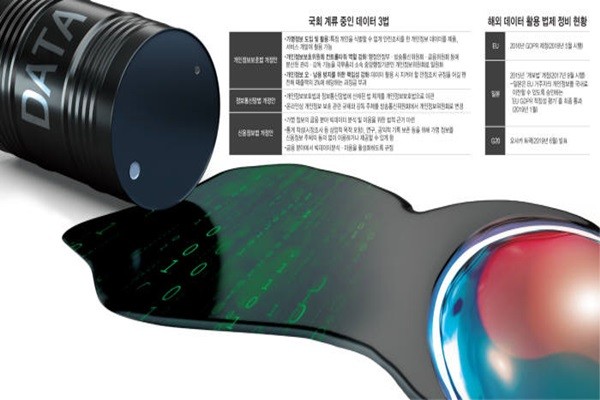

Advanced countries have already regulated data as the ‘oil’ of the Fourth Industrial Revolution and a key resource that will lead innovative growth and completed modifying relevant laws and regulations. On the other hand, South Korean Government has yet to start even a discussion due to political strife. Although oil needs to be extracted to operate the engines of various industries, data industry in South Korea has not seen any light as it is covered under a manhole.

If the amendment of Credit Information Act is foundered once again, experts predict that South Korea will be hit with various misfortunes where resources are depleted for future industries including MyData industry.

◊Why is data innovation needed?

The main purpose to the amendment of Credit Information Act is to allow information under an assumed name to be used legally. Information can be used for a commercial purpose even without a consent from main agents of credit information.

The amendment can bring huge changes to financial field especially. Personalized financial services that are more advanced can be developed if there is a groundwork to innovate financial data. Internet-only banks in China provide loans with medium interest rate for people who lack financial histories through Big Data and they maintain lower delinquency rate than normal banks. This is due to the power of data. Major American insurance companies provide up to 30% discount on insurance rates through data analysis. If Credit Information Act is amended, South Korea can also improve credit rating of people who lack financial histories and provide financial services that are more receptive. There are more than 10 million people in South Korea who lack credit history.

Jobs with good quality can also be created. Top five MyData companies in the U.S. have hired about 13,000 people. As a result, data industry can be linked to South Korean Government’s task in creating jobs for young people.

Data can also be used for personalized asset management services.

The U.S. put out a cash assets management service that analyzes actual income and breakdown of spending through one’s account details and helps people with investments through robo-advisors (RA) last year. As a result, normal people in the U.S. can now use asset management services that are reasonably priced.

◊Advanced countries use data for future industries

When data-based economy is vitalized, it can have a huge impact on preparing a foundation to grow important future industries such as AI, bio, healthcare, and IoT (Internet of Things).

This is because a technology that can learn large amount of data through Big Data and machine learning and performs automated decision-makings can be applied to entire industries.

Effects of data on future industries can be seen through number of patents that other countries hold. The U.S. and China currently lead the international AI industry by actively using data. The U.S. currently holds 26,891 patents related to AI. China, Japan, and Germany have 15,745, 14,604, and 4,386 patents respectively.

Significant amount of synergy can also be expected in healthcare field because a paradigm of health management can be converted from treatment to prevention through Big Data and use of IoT. Finland has established a medical Big Data open system called FinnGen after its Smartphone industry became stagnant. It collected biological samples from 500,000 participants and it has emerged as a leading country in the bio and healthcare industries as a result.

◊Urgency for the amendment of Credit Information Act

In order for South Korea to emerge as one of data powerhouses during the Fourth Industrial Revolution, it needs to amend Personal Information Protection Act, Information and Communications Network Act, and Credit Information Act. If these three acts are not revised, competitive edge of many industries including financial industries will drop.

Due to legal uncertainty, financial and FinTech startups have no choice but to be passive on data analysis and data combination. There is a high chance that MyData and non-financial CB (Credit Bureau) businesses advocated by South Korean Government will remain as an empty cry. Startups that are competing against major companies with relatively low funds and manpower are on the brink of bankruptcy. In a medium to long-term, there will be setbacks to their foreign businesses.

The U.S., China, Japan, and EU have already adjusted their laws and regulations for their respective data industries.

“We need to finish the amendment of Credit Information Act in order to help our small and medium companies that deal with EU to grow.” said a representative for financial authorities. “Just like Osaka Track, South Korean Government must take leadership for digital economy that will accelerate innovative growth.”

Staff Reporter Gil, Jaeshik | osolgil@etnews.com