It is expected that there will be new tax standards on multinational IT corporations in 2020.

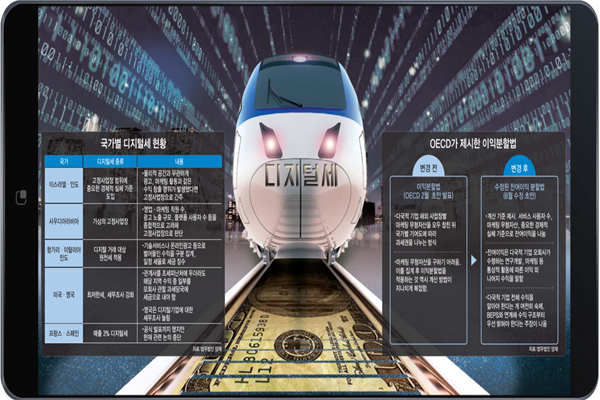

OECD (The Organization for Economic Cooperation and Development) currently holds the initiative. The main issue involves ‘profit split method’. Profit split method divides authority to levy taxes depending level of contribution after combining marketing intangibles from foreign workplaces of multinational corporations.

There are many pros and cons. Some believe that practicality is low due to complicated calculations. OECD is also aware of such concern and it recently introduced a modified plan. By doing so, it confirmed its intention to enforce profit split method.

OECD’s moves have to be paid attention as tax treaty and revision process of internal tax act are inevitable when OECD makes a final decision.

There are still many tasks that need to be resolved. In order for profit split method to take place properly, profit models of multinational corporations need to be transparent. It is difficult to expect effectiveness of profit split method when it is difficult to find out actual sales of multinational corporations.

◊OECD pushing for profit split method

OECD formally announced the draft of ‘digital industry taxation report’ earlier this year in order to establish standards to levy taxes (digital tax) on multinational IT corporations such as Google and Facebook. It is advising the draft elaborately after holding a public hearing for member countries regarding the draft. It is looking to publish a final report in 2020.

Main issues involve fixed workplace and income distribution per country. Current tax system levies corporate tax on these IT corporations by seeing where their servers are located as fixed workplace. Multinational corporations usually have their servers in countries with low tax rate and have taken advantage of their tax systems.

OECD believed that fixed workplace method was abused by these corporations to avoid taxes. As a result, it presented three alternatives that will replace fixed workplace method. It is planning to levy taxes based on a tax system of corresponding country where they earned most incomes regardless of where their servers are located.

First, it designed a tax system centered on location of people who use their services. It considered a characteristic of platform business that improves a company’s value depending level of participation from users. It also introduced a concept of marketing intangible for the first time to see locations where advertisements and marketing take place as virtual fixed workplaces.

It also introduced a plan that gives an authority to a country where important economic acts take place to impose taxes on these corporations. Its plan is to analyze number of employees in business and marketing, size of advertisements, and number of platform users to decide on level of importance of such economic acts.

However, there are controversies surrounding marketing intangibles. Many believe that possibility of implementing concept of marketing intangibles is very low. They believe that it is practically impossible to look for marketing intangibles and to apply profit split method even after calculating marketing intangibles as methods for calculating intangible assets are extremely complicated. Even OECD acknowledged internally that marketing intangible is a standard that has low practicality.

OECD accommodated every concern from member countries and announced a new profit split method that is also called ‘modified residual profit split method’. It is heard that OECD is planning to submit a report that has information on this new profit split method to 20 major countries (G20). Based on this report, G20 is planning to induce an agreement with large framework in January of 2020.

Modified residual profit split method set a standard for dividing residual profit. Number of service users, marketing intangibles, and important economic entities appeared for the first time as standards. OECD is planning to materialize concepts after having continuous discussions with member countries.

Residual profit indicates rest of profit aside from normal profit that includes global marketing activities and R&D that are carried out by multinational corporations. However, there are still issues that need to be resolved such as amount of entire profit of multinational corporations. It is practically impossible to introduce a new system when such information is not disclosed to the public.

Profit split method needs to be promoted along with BEPS (Base Erosion and Profit Shifting) project managed by OECD. Some state that each country needs to understand a profit model of a multinational corporation by utilizing its comprehensive, individual, and national reports.

“We need to prepare for revision process of our national tax act according to current state as OECD is trying to interpret a standard for fixed workplace more extensively.” said Lim Jae-kwang who is an account for LawFirm YangJae. “South Korean businesses also need to prepare themselves by carefully examining BEPS regulation of foreign countries.”

◊UN comes up with its own model for digital tax

While OECD has been struggling to find ways to levy digital taxes, UN introduced its own plan. UN presented its own interpretation in order to take the initiative in digital tax field. It is also planning to submit a report regarding digital tax.

UN is planning to suggest introducing withholding tax system. Withholding tax system has been applied to service industry in the name of protecting developing countries. It resolves situations where taxes on loyalty and profit from services are monopolized by advanced countries and it gives part of taxes to developing countries.

Its characteristic is that it collects taxes during transaction stage. Normally, multinational corporations receive fees for using their services from foreign branches. At this time, withholding tax system orders part of fees to be paid to tax authorities that have control over these foreign branches.

UN is planning to apply withholding tax on digital transaction as well. Its attempt to create balance in taxation between countries receives high praise. However, some suggest that it will not be easy to adjust double taxation at working level.

It still has its own tax treaty model. Although 80% of countries in the world including South Korea go with OECD’s model, other 20% of countries such as the U.S. follow UN’s model.

Staff Reporter Choi, Jonghee | choijh@etnews.com