New university graduates, housewives, and elders who have no history of using credit cards or getting loans will be able to receive loans from banks in the future.

Financial Supervisory Service (FSS) announced that it will be pushing for ‘improvement in unfair credit evaluation practice by banks towards financially neglected class of people’.

South Korean banks have continuously carried out their evaluations centered on financial information that resulted in financially neglected class of people being treated unfairly due to their lack of history of financial transactions even though they have positive credit rating.

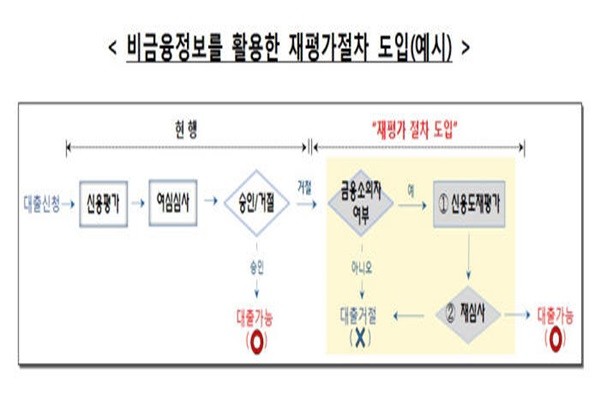

FSS has decided to establish a process sometime during the first half of this year that will reevaluate a person’s credit rating based on non-financial information if he or she is rejected from getting a loan due to lack of history of financial transactions and rescreen whether he or she can receive a loan based on non-financial information.

Non-financial information includes telecommunication, small payments through Smartphones, and history of online shopping transactions. FSS’ plan is to improve credit rating system so that financially neglected class of people is not treated unfairly by banks when they receive loans despite their positive credit rating.

FSS has also decided to supplement relevant systems so that financially neglected class of people is evaluated equally as normal people during loan evaluation process and that results from loan evaluations are applied to loan approval, interest rate, and credit limit gradually.

Reassessment procedure will be first applied to major South Korean banks such as KB Bank, Shinhan Bank, Hana Bank, Woori Bank, and NH Bank and it will be applied to other banks one after the other after 2020.

“We are making sure that South Korean Government’s plan on vitalizing non-financial information is established smoothly within banking industry as well.” said a representative for FSS. “We are planning to diversify evaluation criteria and improve credit evaluation models so that credible credit evaluation systems are established by South Korean banks.”

Staff Reporter Park, Yoonho | yuno@etnews.com