Number of inquiries about how to use South Korea’s first FSDC (Financial Security Data Center) operated by KT-XENO Solution is rising rapidly. FSDC is a service that is optimized for South Korean Government’s plan to expand Cloud services within financial field. As Cloud computing is now able to be used for personal credit information or one’s identifiable information, large financial companies to electronic financial companies are utilizing Cloud for their MyData industry.

Cloud indicates a computing environment where a company does not have to set up computerized systems but receives IT supports such as storage space, platform, and software (SW) from a third-party company. It allows fast approach towards IT support and it reduces investment and management costs for hardware (HW).

South Korean Government is allowing companies to process personal credit information and personal identifiable information such as social security number, passport number, driver license number, and others through Cloud computing since January.

FSDC is currently South Korea’s only Cloud-based financial security infrastructure that obeys every electronic financial supervision regulation set by South Korean Government. It combines servers, storages, and network into servers and it provides a perfectly separate environment to each company. It also has many equipment POC systems by utilizing KT’s technical skills in telecommunication.

It uses IPS (Intrusion Prevention System) that obtained international common criteria (CC) and firewall (F/W) for safe financial services and operates 24-hours security control service to respond to infringement.

Due to its low cost and high efficiency, many commercial banks, electronic financial businesses, and others are inquiring about how to use FSDC.

While FSDC provides infrastructures that are similar to that of private Cloud and is safe and secure, its cost is less than half of a cost of using one’s own Cloud.

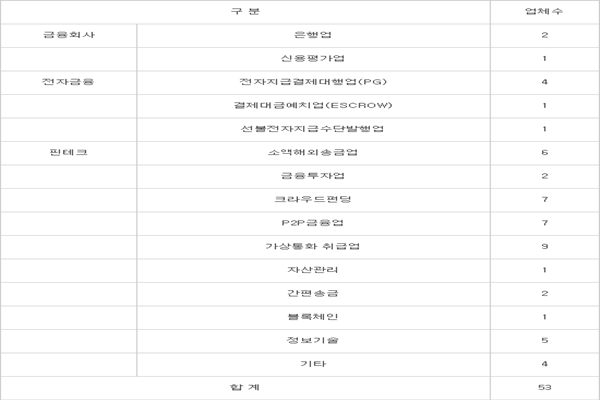

“As regulations on registration of electronic financial industry have been eased, number of inquiries from various FinTech and IT companies about how to use FSDC has risen.” said CEO Kang Dae-sung of XENO Solution. “We currently have meetings with more than three companies per day regarding FSDC.” Currently, 53 companies such as two commercial banks, one credit rating agency, four PG (Payment Gateway) companies, six foreign wire transfer providers, and nine companies that handle virtual currencies are using FSDC.

It is expected that more than 100 companies will be using FSDC at the end of this year when promising FinTech companies such as Rainist and others in addition to NH Bank and IBK (Industrial Bank of Korea) start using FSDC.

FSDC has many professional personnel as well. CEO Kang Dae-sung of XENO Solution that oversees consulting tasks is an expert in electronic finance that has more than 20 years of experience. Personnel who is in charge of system, security, network, and information protection had had experiences working as IT personnel for South Korean banks.

“KT and XENO Solution will continue to find ways to work together in many different angles to secure various financial customers.” said Director Kim Joo-sung of KT.

Staff Reporter Gil, Jaeshik | osolgil@etnews.com