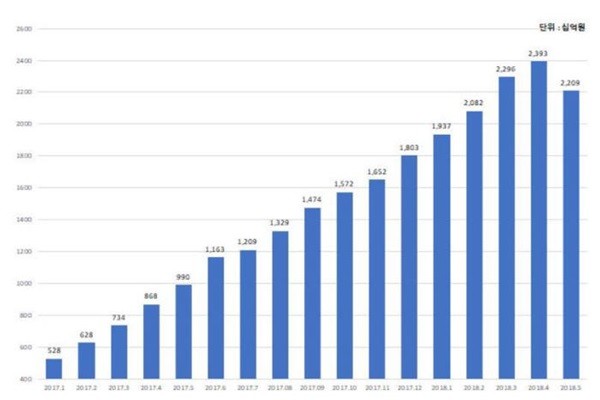

Amount of loans from members of Korea P2P Finance Association was around $2 billion (2.2 trillion KRW) last month. Amount of loans in May was less than that of April as 8 Percent and PopFunding left the association.

Average loan default rate was 3.57% in May. After accommodating advises from Financial Services Commission (FSC), Korea P2P Finance Association started announcing default rate publicly starting from last month’s statistics.

Korea P2P Finance Association made an announcement that amount of loans from 61 members in May was $2 billion (2.2093 trillion KRW). Compared to the amount in previous month ($2.17 billion (2.3929 trillion KRW)), amount of loans in May decreased by $167 million (183.6 billion KRW). Amount of loans that started trending upwards since January of last year started trending downwards for the first time as few companies left the association.

Total of 7 members such as 8 Percent, Popfunding, Villy, Olley Funding, BF365, Friday Funding, and UNI Funding were excluded from statistics starting from last month. Although Friday Funding and UNI Funding out of the 7 members are still maintaining their memberships, they could not submit their documents due to internal affairs.

Average loan default rate was 3.57%, and Korea P2P Finance Association did not record delinquency rate.

In the meantime, Korea P2P Finance Association separated default rate and delinquency rate based on a period of 30 days of delay in repayment. Because overdue is included into delinquency rate when it is extended, there was an optical illusion effect where default rate is relatively low.

Fact that denominator was different when calculating default rate and delinquency rate was another problem. Loan balance and total amount of accumulated loans were used as denominators for calculating default rate and delinquency rate respectively. Because amount of denominator of default rate is bigger than amount of denominator of delinquency rate, delinquency rate is relatively shown lesser than default rate.

Korea P2P Finance Association restructured its public announcement on statistics starting from last month after receiving requests from financial authorities.

“We have decided to publicly announce default rates only when financial authorities requested us to follow standards of different financial industry.” said a representative for Korea P2P Finance Association. “Only those that prefer to announce delinquency rates can do so through our homepage.”

Based on default rate, Edium Funding had the highest percentage with (35.41%) followed by Smart Funding (28.96%) and Angel Funding (26.96%).

Staff Reporter Ham, Jihyun | goham@etnews.com