Korea M&A Center (CEO Yoo Seok-ho) introduced an ICO (Initial Coin Offering) investment model called ‘ESCLOCK’ service that has prepared protection devices for investors.

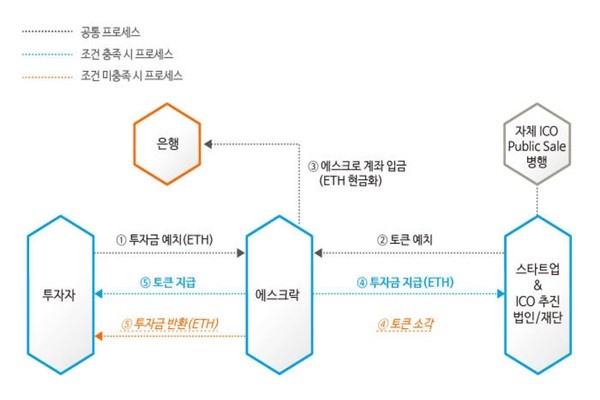

ESCLOCK applied escrow system, which is used for financial markets such as e-commerce, to ICO and it is a model that deposits investments and cryptocurrencies that are newly issued by ICO companies for a certain period of time.

ESCLOCK pays investments only when ICO companies are able to meet certain requirements and it returns investments back to investors if they are not able to meet requirements. It is also equipped with a system that refunds entire investments that are escrowed when there is a problem during ICO process to prepare for any loss that investors may face due to fraudulent ICO.

ESCLOCK pays investments when ICO companies are able to list their exchanges within 6 months from ICO, maintain certain price for a month after listing, and obtain more than 50% of escrowed amount through normal ICO.

Exchanges that are approved to be listed are limited to 30 domestic and foreign exchanges that are determined by ESCLOCK’s evaluation committee. Investors can set up additional options besides basic requirements.

To prevent any damage to ICO investments from fluctuation of Ethereum price, Korea M&A Center liquidates Ethereum as soon as it is received and deposits it into an escrow account.

ESCLOCK’s evaluation group only gives opportunities to ICO companies that finish preliminary inspections to participate in ESCLOCK.

“ESCLOCK is a financial patent model that provides benefits to companies that are pushing for ICO and protects investors while there are so many people in the world suffering from countless number of scams and ICOs that fail to materialize white papers.” said CEO Yoo Seok-ho. “ESCLOCK will be able to develop blockchain ecosystems and establish safe ICO investment culture.”

On the other hand, Korea M&A Center is going to hold an open presentation regarding ESCLOCK’s present and future status on the 10th of May.

Staff Reporter Ham, Jihyun | goham@etnews.com