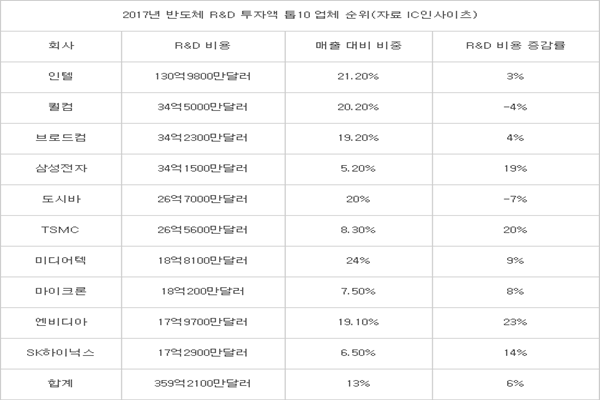

Although Samsung Electronics surpassed Intel in sales and has become the top semiconductor business in the world, it was shown that its amount of investment into R&D is only quarter of the amount Intel is investing into R&D. Amount of investment that SK Hynix is putting into R&D is only about an average compared to other global semiconductor businesses. Some are pointing out if South Korean semiconductor businesses are too stingy when it comes to investments for the future.

According to a market research company called IC Insights’ survey, Intel was the semiconductor businesses that spent the most in R&D last year. It invested $13.098 million which is 3% increase compared to previous year. Amount of investment that Intel spent into R&D corresponded to 21.2% of its sales.

However, Samsung Electronics spent $3.415 into R&D last year despite making more sales than Intel. Although this amount is increased by 19% compared to previous year, it is only quarter of how much Intel spent into R&D. Also, it only corresponded to 5.2% of Samsung Electronics’ sales.

“Amount of Intel’s investment into R&D in 2017 is bigger than the sum of how much Qualcomm, Broadcom, Samsung Electronics, and Toshiba spent into R&D.” said IC Insights.

“Because businesses that specialize in memories and foundries are also investing astronomical amount of investment into facilities as well that it is not too surprising to see how amount of investment into R&D corresponds to only small percentage of overall sales.” said a representative for an industry. “However, Intel has been putting a lot of emphasis on R&D besides facility investments and others for many years.”

Although amount of investments that SK Hynix ($1.729 million) and TSMC ($2.656 million) spent into R&D in 2017 increased by double figures compared to previous year, percentages of their investments out of their sales were only single figure. Percentage of amount of investment that Micron ($2.656 million) put into R&D out of amount of its sales was also only single figure.

Fabless companies who do not have to worry about facility investments are still investing a lot of money into R&D. Qualcomm, who is in second place when it comes to amount of spending for R&D, spent $3.45 million into R&D last year. Its spending corresponded to 20.2% of its sales. However, its absolute amount dropped by 4% compared to previous year. Qualcomm has been its growth suffering as amount of its sales dropped by 5% due to lower amount of shipment of Smartphones. Broadcom became third place by investing $3.423 million into R&D last year.

Toshiba, which is in fifth place, spent $2.67 million into R&D last year. Amount of its investment into R&D in 2017 dropped by 7% compared to previous year. Toshiba Memory is currently going through a procedure of being sold due to loss of investment by its parent company.

NVIDIA, which is targeting AI (Artificial Intelligence) and self-driving car markets with its GPU technology, was shown to be the one that grew the amount of R&D investment the most from 2016 to 2017 out of top 10 global semiconductor businesses. NVIDIA spent $1.797 million into R&D last year which is 23% increase compared to previous year. Amount of its investment corresponded to 19.1% of its overall sales.

According to IC Insights, amount of sum of investments that top 10 semiconductor businesses spent into R&D last year came out to be $35.921 million which is 6% increase compared to previous year. Amount of their total investments corresponded to 13% of amount of their total sales. This indicates that they invested $122 (130,000 KRW) into R&D on average when they made $940 (1 million KRW) in sales.

According to IC Insights’ survey, NXP, Texas Instruments, ST Micro, AMD, Renesas, SONY, Analog Device, and Global Foundry spent more than $1 million each into R&D last year.

Staff Reporter Han, Juyeop | powerusr@etnews.com