Non-face-to-face-based Smart Devices such as AI (Artificial Intelligence) and Smart Home are changing the landscape of insurance industries as insurance industries are set to replace tasks of more than 10 million insurance agents that are in the world with these Smart Devices. InsureTech has emerged as another finance revolution for Industry 4.0.

According to IT and insurance industries, South Korea along with U.S. and Japan are working on creating InsureTech markets.

InsureTech represents a series of services and technologies that improve industries by working with ICT (Information Communication Technology) such as AI, IoT (Internet of Things), and Big Data.

A process of replacing roles of insurance agents with AIs with America at the center has started. When this process is done, one can utilize digital technologies and meet with insurance companies through various channels without having to meet with insurance agents.

Even an internet website (Aggregator) that sells various insurance products to customers was appeared recently. South Korea also started to pioneer InsureTech markets through ‘Insurance All Together’ and others.

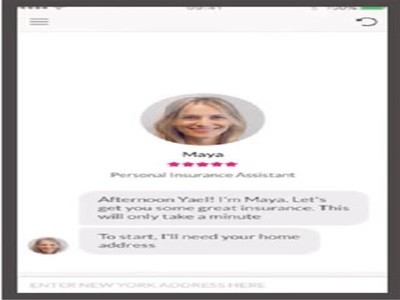

A startup called Lemonade, which is in New York, recently applied its AI chatbot as an insurance model. It applied AI, behavioral economics, and chatbot to every facet of its products. It is the first business in the world to implement a new InsureTech service model that can finish insurance contract and insurance claim in just 90 seconds and 3 minutes respectively. AI is used in screening and estimate of one’s insurance and it can help people set up paperless contracts through their mobile devices and eliminate steps of having to sign and sending documents for confirmation.

Insurance claim is also very simple as it is taken care by a virtual assistant. Insurance application and insurance claim are done by a female virtual assistant called MAYA and a male virtual assistant called JIM respectively.

A foreign multinational business called Fabric recently developed an interesting InsureTech product that mainly targets moms with newborn babies and moms who are taking care of their babies. This product leaves insurance money with children in case something happens to their parents. It is called ‘Fabric Instant’ service and application process just like its name can be done within just two minutes. One can simply enter basic information such as name, date of birth, and social security number online without going through an insurance agent. It costs 6 dollars per month and one is guaranteed 100,000 dollars once he or she joins this service. Until now, life insurance was based on face-to-face meetings with insurance agents. Although it was frequent that insurance agents forced people to buy unnecessarily expensive products, this custom was broken through Instant service.

Changes within insurance industries that sell their products and services through various channels such as phone, internet, social media, and mobile devices are becoming inevitable.

Although South Korea also took its first step towards InsureTech, a process of enhancing technologies and others has not taken place yet.

Many point out that insurance companies need to destroy their business models, distribution network, and sizes of their businesses as soon as possible in order to grab upper hands of insurance industries that are worth billions of dollars as most of insurance agents cannot respond to changes and continue to sell insurance products without even knowing their information well.

On the other hand, if a risk management system that digitalizes every process through AI and Smart Home devices and utilizes Big Data and others is introduced, insurance companies can greatly reduce their cost for operating their insurance agents and prevent various accidents.

“InsureTech allows one to obtain more valuable information on customers through digital distribution and it can lead to increase in sales and profits when it is applied to products appropriately.” said a representative for a consulting company called Accenture. “South Korea also needs to push for enhancement of InsureTech as quickly as possible.”

Staff Reporter Gil, Jaesik | osolgil@etnews.com