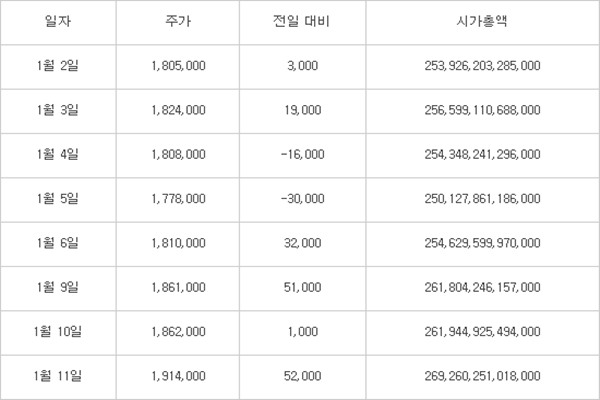

Market capitalization that includes Samsung Electronics’ stocks and preferred stocks surpassed $253 billion (300 trillion KRW) for the first time. This is the first time when market capitalization of a single company from South Korea’s stock market surpassed $253 billion. This market capitalization corresponds to 22% of market capitalization of entire KOSPI (Korea Composite Stock Price Index).

On the 11th, Samsung Electronics’ stocks from KOSPI surpassed $1,597 (1.9 million KRW) for the first time as number of foreign buying continued to increase just like it did on the 10th. This day’s end price was $1,613 (1.914 million KRW) and it increased by $43.83 (52,000 KRW (2.79%)) from previous day. Based on day return, its stocks approached almost $1,627 (1.93 million KRW).

Based on day-end price, its stocks continued to increase for four days straight since the 9th. Its market capitalization lacked about $674 million (800 billion KRW) from $228 billion (270 trillion KRW).

When stock market was opened on the 11th, Samsung Electronics’ stocks shot up to $1,591 (1.887 million KRW) immediately and surpassed its all-time day return, which was made two days ago, of $1,580 (1.875 million KRW). Although institutional investors put on the markets, foreign investors collected most of them and pushed up Samsung Electronics’ stocks.

Samsung Electronics’ preferred stocks are also making record-setting values. On the 11th, Samsung Electronics’ preferred stocks recorded $1,296 (1.537 million KRW) which is $50.57 (60,000 KRW (4.06%) increase from previous day based on day-end price. Market capitalization for its preferred stocks easily surpassed $26.1 billion (31.0 trillion KRW).

Excluding investigations from prosecutors, Samsung Electronics is enjoying increase in its stocks. Its plan of improving shareholder value was announced at the end of November in 2016 and it announced its fourth quarter performance that surpassed $7.59 billion (9.00 trillion KRW) on the 6th of this month. Economy of semiconductor industries is carrying a positive trend and recovery for sales volume of Smartphone is now underway.

Rumors regarding a change in holding company are coming out consistently. There are also reports from stocks firms that say that Samsung Electronics will push for a change in holding company through equity spin-off before this term of South Korean Government ends. There are also rumors that Samsung Electronics will carry out stock split as its stocks are skyrocketing.

All of these are turning foreign investors’ hearts towards Samsung Electronics. Samsung Electronics’ stocks that foreign investors had purchased since the 27th of last month surpass $253 million (300 billion KRW).

Experts emphasize that Samsung Electronics’ stocks are still undervalued.

“Even if one looks at Samsung Electronics’ yearly operating profit to be $33.7 billion (40.0 trillion KRW), its market capitalization which will be $219 billion (260 trillion KRW) is still not expensive as it does not equal to ten times of net profit.” said Vice-President Heo Nam-kwon of Shinyoung Asset Management who is an expert in value investing. “Because it was never more expensive than same line of foreign businesses and is constantly undervalued, its stock still has potentials to go up even more.”

On the other hand, SK Hynix, which is number two in market capitalization, is also recording its new high for five days straight. SK Hynix, which finished the 11th with $43.49 (51,600 KRW) which is $1.56 (1,850 KRW (3.72%)) increase from previous day, neared its highest price of $44.17 (52,400 KRW) that was made in July of 2014.

Staff Reporter Lee, Seongmin | smlee@etnews.com