South Korean Government has selected ‘blockchain’ to expand the scope of FinTech and is going to push for trial projects in financial industries within this year as part of major technologies for Industry 4.0.

Financial Services Commission (FSC) held a second meeting for ‘FinTech Development Conference’ at Government Complex-Seoul and decided on a roadmap that will promote blockchain with organizations and experts that are participating in blockchain consortium.

In December of 2016, 16 banks and 25 stock firms formed a consortium in order to use blockchain technology. These financial companies have agreed to establish a co-blockchain platform during first half of this year and start pilot services by end of this year.

Banks that are participating in this blockchain consortium is planning to research on ways for its customers to easily process changes in foreign designated banks by utilizing blockchain technology. As of right now, they are only able to change foreign designated banks after mailing complicated documents and go through confirmation process.

Financial investment industries have also decided to research on ways to comprehensively manage problems that occur from customers having to individually log-in and go through verification procedure when they deal with many stock firms by utilizing blockchain technology.

FSC will include methods for promoting blockchain to ‘2nd step of roadmap for development of FinTech’ and will help financial companies in all directions so that corresponding technologies can safely land on markets. Detailed methods for second step of this roadmap will be announced during first quarter of this year. Also it is going to regularize operation of co-blockchain consortium of financial industries.

“Expansion of blockchain technology along with Bill of Rights will trigger ripple effects that fundamentally change entire societies.” said Vice-Chairman Chung Eun-bo of FSC. “We need to lead changes and innovations in FinTech sectors by accommodating blockchain technology in financial fields especially in advance.”

“South Korea is the world’s best ICT country and possesses optimal environment that can lead Industry 4.0 that includes blockchain.” said Professor Lee Gun-hee of Sogang University. “Reformations such as easing of drag along and improvement in regulations based on offline are needed in order to have innovative businesses to be active.”

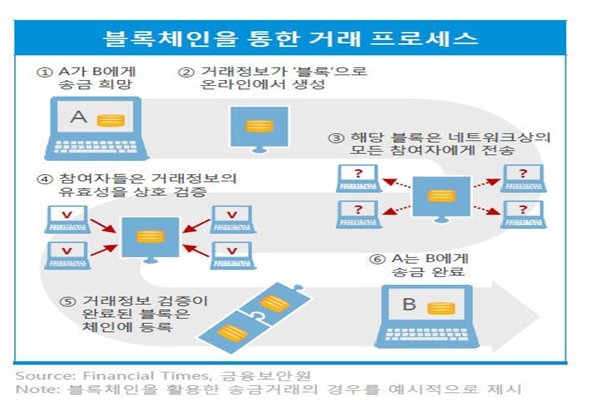

Blockchain is P2P network and it is a technology that allows participants to co-record and co-manage ledgers that have information on transaction by distributing them to man network rather than saving them into a central server of a particular organization.

When blockchain is installed within a financial service, there is no need for a central administrator. Also as there are more participants, integrity of data will also increase.

Experts evaluate blockchain as an important technology that can change current financial ecosystems. This indicates that dispersed ledgers and participating value chain technology will become momentums that are needed for Industry 4.0

Major foreign banks are already using blockchain technology for trade or researching on ways to apply it to issue e-checks.

In South Korea, banks have developed and are providing service that records warranty into blockchain when a person does financial trade from a bank and service that easily verifies one’s identity when a person uses a mobile card. Korea Exchange is using blockchain technology to transaction platform of KSM, which is a market that opened in November of 2016 for start-up companies.

Staff Reporter Gil, Jaeshik | osolgil@etnews.com