Out of KOSDAQ-listed fabless manufacturing businesses that design semiconductors, more than half of them are going through internal struggles due to performance slump. Some businesses have been de-listed or gone bankrupt. Some of businesses are also on the verge of being de-listed this year and this has many worried that backbone of South Korea’s semiconductor industry might break.

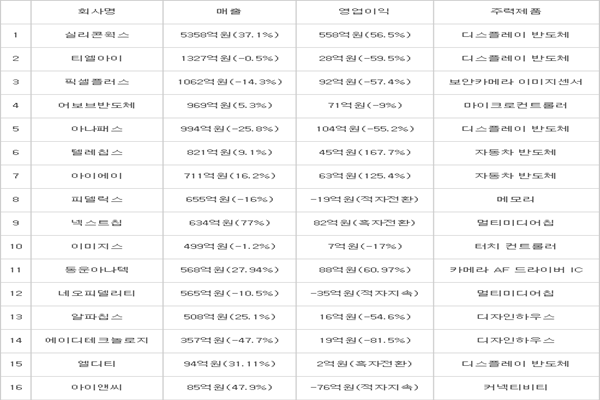

According to last performance report that was submitted by KOSDAQ-listed semiconductor design industry to Financial Supervisory Service, sales and profit for 9 businesses out of top 16 businesses fell by more than 30%. While performance for businesses that specialize in analog and automotive semiconductors has increased, downward trend of performance for businesses that specialize in Display IC and image sensors was huge.

Last year’s operating profits for TLI and Anapass, which specialize in Display IC, fell by 59.5% and 55.2% compared to 2014 respectively. Performance in chip field had fallen sharply as display industry was struggling through lack of demands in front-end industry such as TV and others. Although LDT, which had been making losses for 2 years in a row, succeeded in making surplus last year, it barely passed break-even point. Sales for this company that specializes in OLED Display IC in 2007, which was before being listed in KOSDAQ, was $21.5 million (25.5 billion KRW) which is twice the sales of last year ($7.91 million (9.4 billion KRW)) and its performance has been falling sharply since 2013. Sales and profit for Images, which specializes in touch chip, have decreased as many Chinese fabless manufacturing businesses have entered related businesses and intensified competition in price. Although sales for ABOV Semiconductor, which specializes in MCU (Micro-Controller Unit), increased, its profit decreased.

Operating profit for Pixel Plus, which entered KOSDAQ market last year, had fallen sharply by 57.4% compared to 2014. Its major product is image sensor for security cameras and its sales and profit had fallen greatly as competition had become intensified last year. Sales for Fidelix, which is a memory chip fabless manufacturing business, decreased by 16% last year and its profit had also changed to loss. This business was bought by Dungshin Semiconductor last year.

There are also businesses that need to overcome being de-listed. INC, which was doing well in past years with DMB Chips for cellphones, had been recording loss for 4 years in a row until last year and will shortly be designated as an administrative issue. Although it had tried to promote wireless LAN and PLC (Power Line Communication) Chip fields as new businesses, it did not work so well. A business is kicked out of KOSDAQ if it records a loss for 5 years in a row. Neo Fidelity, which deal with products in multimedia field, had been making loss for 3 years in a row until last year. If it does not make surplus this year, it will be designated as an administrative issue. There are predictions that businesses that are about to be de-listed will think about selling their businesses.

Core Logic, which was once considered as one of biggest South Korean fabless manufacturing businesses, currently has its transactions on hold due to possibility of impaired capital. If it does not resolve this matter by the 30th of this month, it will be de-listed. Core Logic is currently thinking about selling its business. Mtekvision, which once had led South Korean fabless manufacturing industry with Core Logic in beginning and middle of 2000s, was already de-listed in 2014.

As fabless manufacturing businesses struggle, performance for design house industry also fell greatly. Design house industry is in charge of back-end work in design such as manufacturing and testing of mask that is used for actual production and others according to each foundry business’s processes. AD Technology, which is designated as the design house for TSMC, had its operating profit decrease by 81.5% last year. Operating profit for Alpha Chips, which is a design house partner of Samsung Electronics, also decreased by 54.6%. South Korea’s design house ecosystem is already collapsed. DAWIN Technology (currently Hancom GMC), which was once South Korea’s biggest design house business, had to give up its design house business once it was bought by Hancom.

“We need to change the word ‘Powerful Nation in Semiconductor’ to ‘Powerful Nation in Memory’.” said a representative for this industry. “South Korean fabless manufacturing businesses that need to be the backbone of semiconductor industry are never strong in system semiconductor field.”

Staff Reporter Han, Juyeop | powerusr@etnews.com