Power semiconductor businesses, that failed twice already from preliminary screening for validity, are trying for a third time. They believe that they cannot delay any longer since importance of power semiconductor technologies and market are increasing in electric cars, automobile parts, and others. Expectations are growing bigger on whether or not South Korean power semiconductor businesses can speed up in developing technologies as Pusan Metropolitan City joins in establishing groundwork and Hyundai and Renault Samsung Cars participate as businesses that demand those technologies.

Ministry of Trade, Industry & Energy (MOTIE) recently applied for another preliminary investigation to Ministry of Strategy and Finance for validity of next generation power semiconductor business. This business is pushed by the government so that it can create new growth engine in South Korean semiconductor business and expand industrial structure centered on memory towards non-memory field. Government has been receiving preliminary investigation for validity since 2012 as this business was selected as a task of government’s ‘Development-Type New Growth Engine in Industry Project’ in last 2011, but it failed every time.

Although business last year was planned based on next-generation compound semiconductor, it did not even receive actual screening because possibility of commercialization and technology standard were pointed out as problems.

MOTIE readjusted planning of this business and newly included Pusan Metropolitan City and private businesses. It established groundwork for next-generation power semiconductor and increased its will to commercialize it one more notch as Hyundai and Renault Samsung Cars along with integrated device manufacturers (IDM) are participating as businesses that demand those technologies. Automobile manufacturers also rolled up their sleeves in commercializing South Korean power semiconductor business as demand for power semiconductor for automobiles increase and competition for technologies becomes fiercer due to recent rise of electric cars and intelligent cars.

Power semiconductor is a chip that is used at a power plant to change electric power that is produced to each use. With that in mind, MOTIE is trying to minimize loss of powers during transmission and change and maximize efficiency. Because it can reduce energy, it is being demanded in variety of fields.

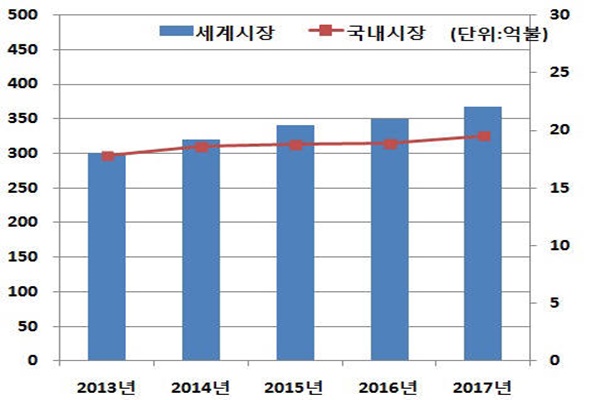

Experts are pointing out that South Korea’s power semiconductor market usually ends up with technologies that produce inexpensive chips. If it wants to respond to market hereafter, it needs to have technologies to mass-produce highly efficient power semiconductor that requires high performance and safety like cars. According to market investigative business called Isuppli, world’s power semiconductor market and South Korean market are worth $34.1 billion and $2 billion respectively. However actual production in South Korea is only about $300 million.

MOTIE along with the government and private businesses are investing about $169 million (200 billion KRW) for 7 years from 2017 to 2023 to develop next-generation compound power semiconductor that replaces silicon and major components of power semiconductor. It is also going to push for development of power control System on Chip 417 (SoC) that is appropriate for IoT80 market.

MOTIE is also preparing groundwork of research, production, technology support for next-generation power semiconductor in Pusan Metropolitan City because it believes that it can establish an industrial system that will speed up commercialization of technology development, production, and support since there are many infrastructures in Pusan Metropolitan City that demand a lot of power semiconductor for cars, machineries, shipbuilding, and others.

It is planning to use current facilities with National NanoFab Center (Daejeon), Korea Advanced Nano Fab Center (Suwon), and National Institute for Nanomaterials Technology (Pohang) that are national fabrication facilities and also expects an effect that will raise rate of operation of facilities.

“Semiconductor advanced countries such as the U.S. and Japan are already investing hundreds of million dollars with private businesses in developing next-generation power semiconductor technologies. As it is predicted that power semiconductor market will grow to same level of D-RAM and NAND-Flash markets, competition in securing source of next-generation Silicon Carbide (SiC) technologies is very fierce.” said Son KwangJoon who works as system semiconductor PD.

Staff Reporter Bae, Okjin | withok@etnews.com