Xiaomi announced that it is planning to sell major home appliances such as TVs, water purifiers, and etc. in Korea, and Chinese distribution market trend is coming near. Xiaomi who started selling small-sized home appliances and accessories starting from end of 2014, is putting out TVs and water purifiers in Korea instead of its strength that is Smartphones. It is an item that it is planning to compete against Korea’s large home appliance businesses for.

Xiaomi’s Smartphones have many restrictions in entering foreign markets due to its ties to communication company, problem with intellectual property right, and etc. Due to this reason, it seems that it is planning to test the waters with accessories and small-sized home appliances first then enter large-sized home appliances and informational home appliances markets in full-scale. If Xiaomi secures constant share in Korean market, where home appliances and Smartphones are its strengths, global entrance will be visualized. It seems as if Korean market will be strategic test bed for Xiaomi’s distribution of home appliances and informational home appliances.

“It can be seen as that Xiaomi is testing the water in market for a while because Xiaomi entered Korea through distributor instead of establishment of business network. If it feels out possibility of success in Korea, where it is a major battleground for home appliances, it will increase its line to Smartphones passing TVs and water purifiers.” said a person affiliated with home appliance industry about Xiaomi’s future if it succeeds its goals.

Point of views whether or not Xiaomi’s TVs and water purifiers will be successful are different. Xiaomi’s ‘Performance Compared to Price’ is definitely appealing. Unlike how previous Chinese home appliance businesses focused on selling cheap economic products, Xiaomi is entering Korea with similar specifications as of Korea’s major businesses. Its price is almost half of Korean products.

Fact that number of Korean consumers who are sensitive to price such as people who use online to buy foreign goods directly is increasing recently is definitely an opportunity for Xiaomi. There is an observation that had been confirmed of possibility of Xiaomi succeeding in medium to small-sized products. Recent trend of major distributors is that they want more manufacturers that produce variety of products rather than thinking about countries.

If it is able to achieve certain level of shares in initial online sales, level of Xiaomi’s attack will change because success in Korean market will definitely affect its sales in North America, Europe, or other Asian countries. Possibility of Xiaomi focusing on investing in marketing resource by setting Korea as an important strategic place for world’s TV and home appliances cannot be left out.

Some people see Xiaomi’s act as being strong initially but weak later on. Unlike small-sized home appliances and accessories, TVs are major items for Samsung Electronics and LG Electronics. They already established strongholds, and more than 95% sales of TVs in Koreaare Samsung and LG products. Even Japan’s Sony and Europe’s Phillips pulled themselves out of Korean TV market, and this makes Korea a graveyard for foreign countries just like China and Japan. Coway even has better technology levels and best sales and maintenance structure than Xiaomi in water purifiers. It is not easy for Xiaomi to surpass Korea’s large businesses’ strengths such as establishment, maintenance, and follow-up management in short period of time. Xiaomi is even a less developed TV manufacturer in China than TCL, Changhong, Skyworth, and others.

Even Samsung and LG are not hugely affected, it is a definitely a warning sign for medium to small-sized manufacturers. Korea’s many medium to small-sized home appliances manufacturers such as Dongbu Daewoo and others have lower brand awareness than Xiaomi and it is hard for them to make cheaper products than Chinese products. If Chinese businesses enter Korea’s already stagnant home appliance market, there will be fewer spaces for Korean medium to small-sized set businesses to stand. A person in distribution industry is predicting that effect of Xiaomi’s entrance in Korean market on Korean market and industry will depend on how focused Xiaomi is on this business strategy.

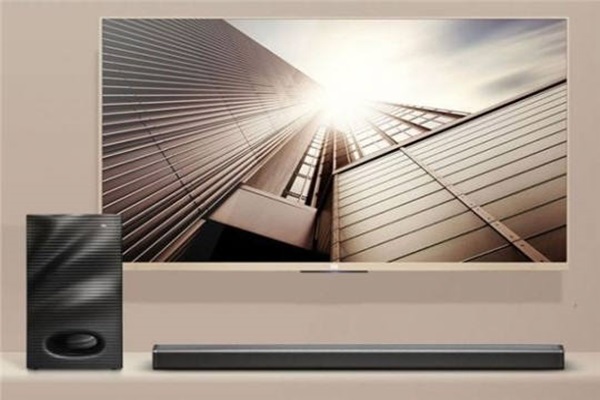

Starting from end of 2014, Xiaomi started selling cases, selfie sticks, air cleaners, scales, Mi Band (type of Smart Watches), action cams, Smart Lamps, internet routers, IP cameras, USB fans, and others in Korean markets. It will shortly increase its product lines by selling TVs, water purifiers, and even humidifiers. It will soon pass online business transactions (open market, social commerce 94) and expand its distribution channel even to offline markets.

Senior Reporter Kim, Seungkyu | seung@etnews.com