D-RAM for server application is leading growth of memory semiconductor market due to its high growth rate. Market for D-RAM for PC application declined as PC market is slower than expected this year, and it seem as if growth of D-RAM for mobile application can be slow as well due to limitation in growth of Smartphone market. On the other hand D-RAM for server application is rapidly growing in all of D-RAM market as Cloud Data Center is rapidly increasing.

Market investigative company called HIS predicted today that growth of D-RAM for server application will have widest range in all of D-RAM market as it will annually grow 13.8% from 2014 to 2019. Its market size last year and this year were $7 billion and $8 billion respectively and its market size for next 4 years are $8.4 billion (2016), $9.8 billion (2017), $11.7 billion (2018), and $13.4 billion (2019).

As it seems that growth of all of D-RAM markets will turn around in 2016 and maintain similar level until 2019 after growing a little this year, D-RAM for server application market is getting a lot of interests due to its continual growth by itself.

As all of D-RAM markets grew a little from $46.2 billion to $48.6 billion, IHS is predicting that its growth will turn around as it will record $44.2 billion in 2016. It is analyzing that the market will be stagnant for many years as its size in 2017, 2018, and 2019 will be $44.1 billion, $46.3 billion, and $48.3 billion respectively. IHS is predicting this trend because D-RAM for PC application will be in slump due to decrease in PC sales and growth of D-RAM for mobile application will be limited due to slowdown of sales in Smartphones.

IHS is predicting that growth of D-RAM for mobile application will stop at 4.1% per year as it recorded $16.3 billion and will record $20.0 billion in 2019.

Downward trend of D-RAM for PC application is very steep. As its size decreased from $12.1 billion last year to $10.3 billion this year, IHS is predicting that its size will continue to decrease as it will be $7.2 billion (2016), $5.3 billion (2017), $4.2 billion (2018), and $3.6 billion (2019). This is as if the market decreased fourth of what it used to be in just 5 years.

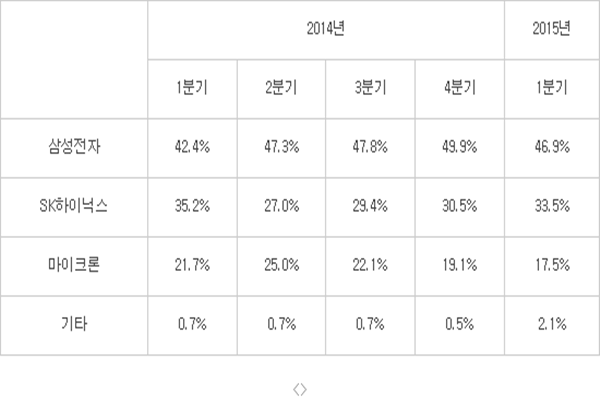

As importance of D-RAM for server application is getting bigger in market, IHS is predicting that control that Samsung Electronics and SK Hynix will have in the market will become even bigger. In first quarter of D-RAM for server application market, Samsung Electronics and SK Hynix were number 1 and 2 respectively as their sales were $143 million and $102 million respectively. Gap between them and number 3, which is Micron ($53 million), is huge. Their shares are 46.9% and 33.5% respectively, and it is as if Korean businesses take up more than 80%.

Korean businesses also take up more than 80 in D-RAM for mobile application market. Although its growth is slow, D-RAMs for mobile application along with server application are settled as major product lines.

Samsung Electronics and SK Hynix are focusing on expanding importance of DDR4 for server application and LPDDR4 for mobile application. Samsung Electronics is planning to increase competitive edge in its production cost in second half by speeding up changes in 20-nano process so that it can increase sales of DDR4 and LPDDR4. SK Hynix is planning to decrease importance of producing DDR3 and increasing importance of DDR4 and LPDDR4.

Staff Reporter Bae, Okjin | withok@etnews.com