Following Samsung Electronics, SK Hynix will begin in the third quarter a mass production of 3D vertical NAND, transistors stacked up in 36 tiers. Not only Toshiba, No. 2 in the world NAND flash market, but also Micron and SanDisk will start mass-producing 3D NAND from the fourth quarter. As the 2D market is to be quickly replaced by 3D NAND, the 3D NAND era is expected to begin in earnest in the second half of the year.

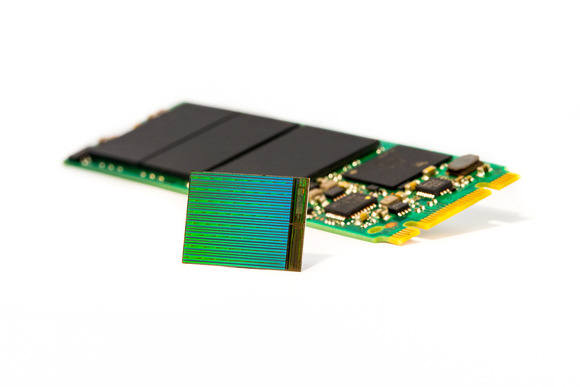

The Second Generation(32 tiers) Triple Level Cell(TLC) 3D NAND, which was first mass-produced by Samsung Electronics, shows similar performance with the 16 nanometer(㎚) processed 2D NAND. The higher the vertical laminar level becomes, the more fixed costs decrease and no additional process transition investment cost is needed, and thus, the rate of return gets higher. This is why NAND manufacturers are speeding up on the development of 3D NAND with a higher laminar level.

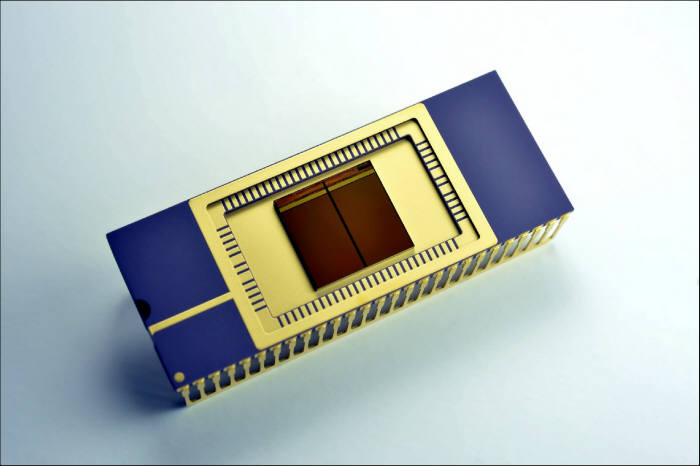

Samsung Electronics, which started the 3D NAND, applied the high-capacity V NAND to the Solid State Drive(SSD) and has prepared a SSD product group for all PCs including laptops, desktops, etc. By increasing the rate of SSD with a capacity higher than 500GB, they are speeding up on dominating the market.

SK Hynix will finish the development of the second generation 36-tier 3D NAND in the beginning of the third quarter and proceed mass production. This is a strategy to open the third generation(48 tiers) 3D NAND era by starting 3D NAND preliminary verification at the end of the year.

By also responding to SSD market demands such as high-capacity smartphones, enterprise, and PC, they aim to expand SSD sales, which are relatively lower than competitors’. TLC structure applied SSD is to be mass-produced in the 3rd quarter. The proportion of 3D TLC NAND in the whole SSD until the end of the year was decided to be around 20~30%.

Toshiba, No. 2 in the world NAND flash market, is also preparing counterattack. With their strategic partner, SanDisk, they are developing 3D NAND with 48 tiers and providing samples to client companies. Unlike domestic companies that apply the TLC technology in which 3 bits are saved in one cell, these are Multi Level Cell(MLC) products that save 2 bits.

Toshiba plans to mass-produce 48-tier 3D NAND at the Yokkaichi factory in Japan next year. The capacity is 128Gb. They have a strong crisis awareness to not lose the leading position in NAND flash, although they have yielded the top position in the DRAM market to Samsung Electronics.

Micron and Intel also announced that they will start producing at the end of the year the 256Gb capacity 32-tier MLC NAND and the 384Gb capacity TLC NAND. New NAND based SSD will also be developed and released in the market next year. It is especially urgent for Intel to mass-produce 3D NAND, since their shares in the SSD market last year were 17%, about half Samsung Electronics’ shares(34%).

The industry expects the 3D NAND market to quickly grow larger in scale starting from next year, as 3D NAND mass production begins in earnest in the second half of the year. This is because the demand for high-capacity products that require 3D NAND such as SSD, mobile NAND, etc. is quickly increasing.

According to the market investigation enterprise, IHS, shares in the world NAND flash market were: Samsung Electronics 36.5%, Toshiba 31.8%, Micron 18.9%, SK Hynix 12.8%.

Meanwhile, DRAMeXchange predicted that the TCL NAND will take up 45% of the whole NAND market until the fourth quarter, since high-capacity TLC NAND installation rates in smartphones, tablets, and consumer electronic products have risen and NAND performance has improved as the controller technique matured. They analyzed that the fall of the price to about 80~85% of MLC also plays a role.

Staff Reporter Bae,Okjin | withok@etnews.com